DCM Velocity

AI-driven investment advisory platform designed to provide clients with enhanced transparency, control, and usability. By simplifying complex financial processes and offering detailed insights, it empowers users to make informed investment decisions tailored to their goals.

00

problem

Data Capital Management (DCM) faced significant challenges in providing transparency and control to clients utilizing its AI-driven investment advisory platform. While the technology behind the platform was advanced, clients struggled to understand the rationale behind AI-generated investment strategies, creating a trust gap. Additionally, the platform’s user interface lacked the necessary clarity and functionality to empower clients in actively managing their portfolios. This lack of transparency and usability not only hindered client engagement but also limited DCM’s ability to differentiate itself in the competitive financial services market.

solution

To address these challenges, DCM Velocity was redesigned with a focus on transparency, usability, and user empowerment. A cohesive design language was developed to present complex financial data in a clear and intuitive manner. The platform introduced detailed, theme-based investment strategy pages with analytical insights, enabling clients to understand and evaluate AI-driven recommendations. A robust portfolio management interface was implemented, offering users real-time performance tracking and full control over investment allocations. Additional quality-of-life features, such as interactive charts, educational resources, and responsive design, ensured a seamless user experience, fostering trust and engagement.

Data Capital Management (DCM) is a New York City-based digital investment research, services, and advisory firm specializing in AI-driven systematic trading strategies. Their project, DCM Velocity, aims to offer clients—sophisticated individual investors, family office CIOs, and affluent individuals—complete transparency and control over AI-backed investment decisions.

The DCM Velocity platform was designed to provide unparalleled transparency, intuitive usability, and enhanced control over AI-driven investment strategies. Key elements of the solution included:

Design Language Development: A unified design language was crafted to transform complex financial data into visually intuitive formats, enabling users to navigate the platform effortlessly and understand investment strategies at a glance.

Theme-Based Investment Strategies: Each strategy was clearly articulated with supporting analytical insights. These detailed pages offered comprehensive information on risk parameters, historical performance, and AI-driven forecasts, empowering users to make data-backed decisions.

Portfolio Management Enhancements: A robust portfolio interface was built, allowing users to drill down into specific investments, assess real-time performance metrics, and reallocate funds as needed. This feature offered complete control over investments while keeping the interface approachable for non-experts.

Quality of Life Features: Additional functionalities like interactive charts, real-time alerts, and FAQs about AI decision-making were implemented to demystify the technology and provide a richer user experience.

process

The development process was meticulous and user-centric, ensuring the platform aligned with client needs and organizational goals:

Discovery Phase

Conducted workshops with stakeholders and users to identify pain points, goals, and expectations.

Deep-dived into the financial and AI-driven investment domain to understand nuances, terminology, and use cases.

Defined success metrics focusing on usability, transparency, and user satisfaction.

User Experience and Interaction Design

Created user personas and mapped key user journeys to identify bottlenecks in the investment process.

Developed wireframes and prototypes, which were iteratively tested with users to refine the design and functionality.

Prioritized features that enhanced decision-making and reduced friction in portfolio management.

User Interface Design

Designed visually engaging and accessible screens based on a cohesive design system.

Ensured responsive design for seamless usability across desktop and mobile platforms.

Conducted usability testing to gather feedback and ensure the final interface met client expectations.

Development and Rollout

Collaborated with engineering teams to integrate the design into the final product.

Rolled out the platform incrementally, allowing for real-time feedback and iterative improvements.

outcomes

The revamped DCM Velocity platform delivered substantial improvements across key areas:

Enhanced Transparency

Users gained deep insights into the rationale behind AI-driven investment strategies through detailed explanations and interactive tools.

The inclusion of educational content helped bridge the gap between advanced technology and user understanding.

Improved Portfolio Control

The ability to reallocate funds and monitor investments in real-time empowered users to actively manage their portfolios.

Interactive dashboards provided a clear view of performance metrics, enabling informed decisions.

Increased User Trust and Engagement

Social proof elements like testimonials and case studies built credibility, while consistent feedback loops fostered trust.

The platform’s intuitive design ensured a smooth learning curve for new users, increasing user retention.

Business Impact

Higher client satisfaction rates led to improved customer retention and acquisition.

The platform positioned DCM as a leader in AI-powered investment advisory by demonstrating its commitment to transparency and user empowerment.

year

2018

timeframe

1 year

tools

Figma

category

UI/UX

01

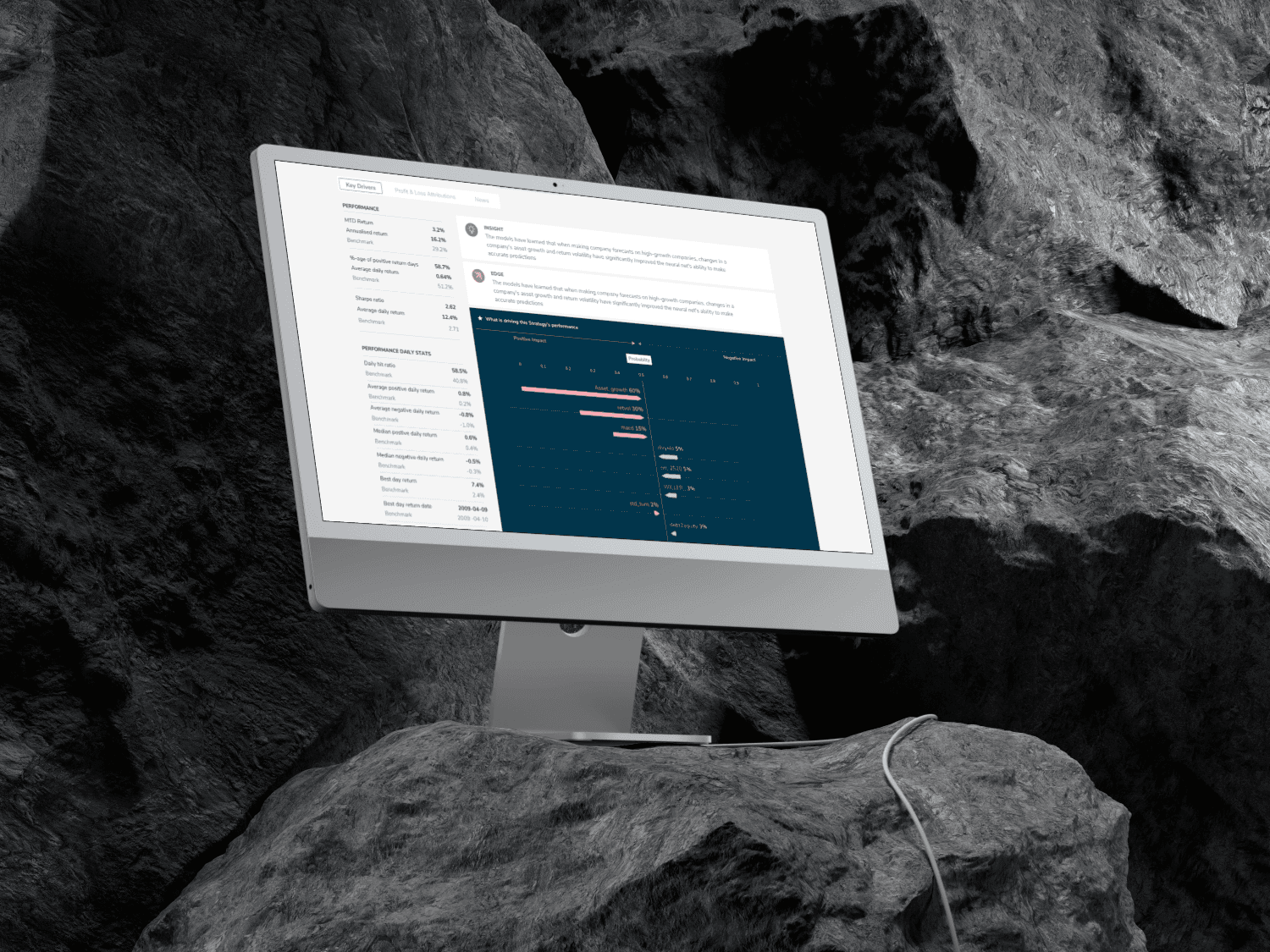

A strategy screen showing a fund manager how the AI learns and invests

02

An interactive FAQ section for an investor to understand more about DCM

03

A strategy fund allocation screen showing a 3 step process to invest into a strategy